Understanding your options to pay for deep retrofit projects in Alberta

Authors: Leanne Komaromi, Jessica Lajoie and Michelle Hauer

When considering a deep retrofit project, there are a wide range of financing products and grant opportunities available to building owners. But navigating these options can be overwhelming. In this blog, we’ve provided a high-level overview of the common ways retrofit projects can be funded. Not all of these will be available or feasible for your retrofit project, and the financing options you choose can have an impact on your project scope and timelines. It may also be possible to combine various options for different stages or aspects of your project. Planning how you will pay for your retrofit project takes time, but learning about your options is a great first step.

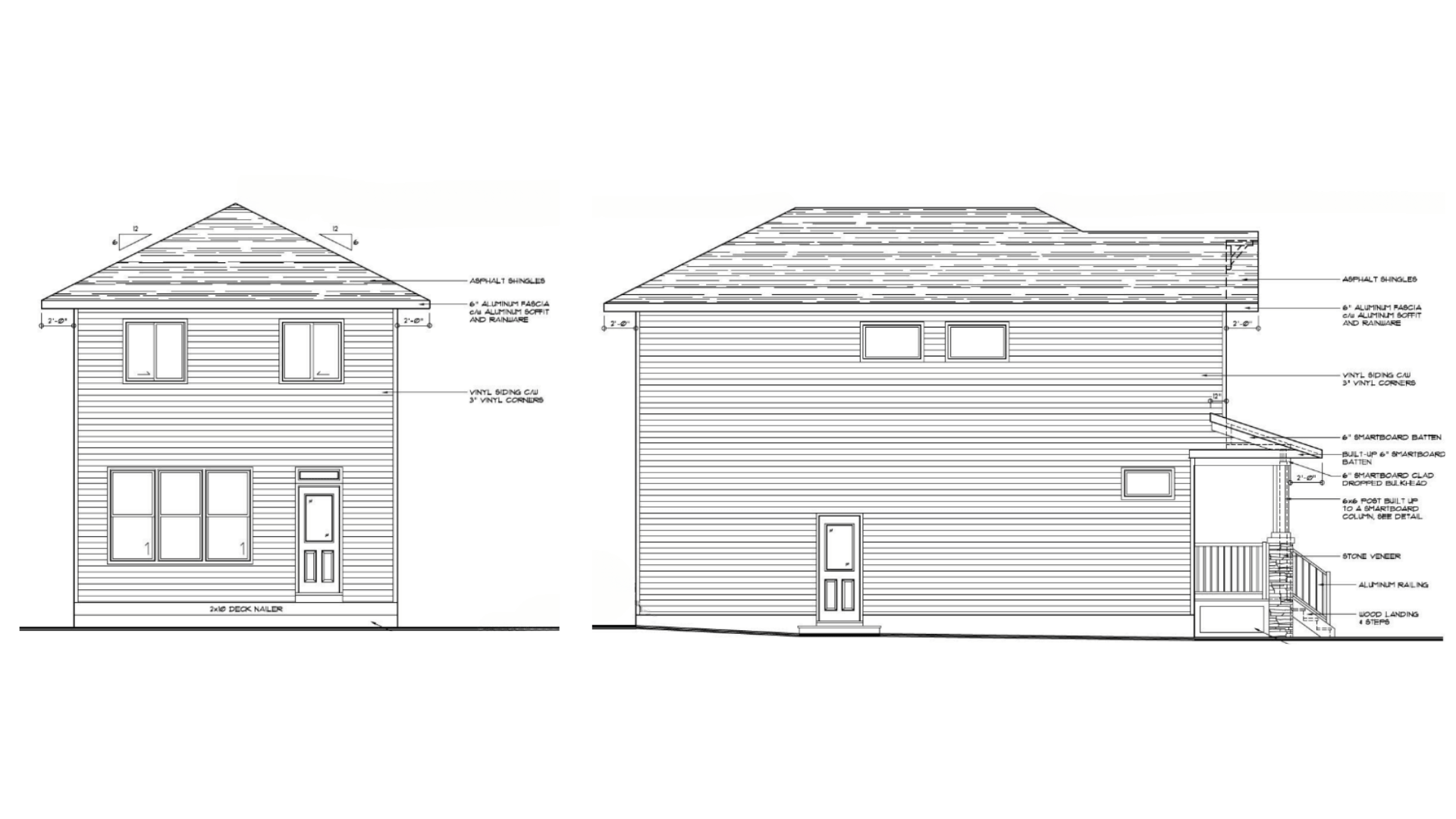

What is a deep retrofit?

A deep retrofit goes beyond standard upgrades and takes a whole-building approach to optimizing energy performance and achieving meaningful carbon emissions reductions. This approach considers all systems and components in a building and involves upgrading some or all of them.

What are my options to pay for a deep retrofit?

There are many ways to pay for retrofits. Not all are universally available, and what’s right for you will depend on many factors, including your goals and the size and complexity of your retrofit project. Different solutions may be preferable for different stages or aspects of your project. These are some of the most common options, who they are best suited to, and things to think about when considering each.

Grant funding

Grant funding is typically delivered through government or utility-run programs as funds that don’t need to be paid back or as forgivable loans.

Suited to: Eligible recipients as defined by the grant program. These opportunities are primarily available to non-profits, governments and public institutions.

Considerations: Grant programs often have strict eligibility requirements and limited funds. Application and approval processes can be time-consuming and should be worked into project timelines.

Internal capital / Self-funding

Self-funding a project uses money that is already available to an organization. This can include capital reserve funds, internal capital budgets for maintenance, or pre-approved borrowing (e.g., a line of credit).

Suited to: Organizations with well-defined budgets or capital request processes. Entities with access to low- interest borrowing (e.g. municipalities).

Considerations: Competing internal priorities and approval processes can make it difficult or slow to access pools of capital. There may be internal hurdles that retrofit projects would have to meet.

Commercial borrowing

Including construction loans, mortgages and equipment financing

With this option, short-term, interest-only loans are used to finance the active construction phase of a project, which may then be rolled into a mortgage. Equipment financing loans are usually smaller loans available for specific equipment assets.

Suited to: Income properties (multi-family rental; commercial). Comprehensive upgrade projects, often undertaken for purposes other than energy efficiency.

Considerations: Lenders typically require collateral or security. Interest rates are risk-adjusted for the project and the client.

Equity financing

Including limited partnership arrangements

With equity financing, capital is raised through the sale of shares or ownership stake in the project.

Suited to: Project developers looking to distribute risks and rewards across several partners.

Considerations: Can be time-consuming to attract partners and negotiate the agreements.

Energy-savings-based borrowing

Including energy performance contracts and energy savings performance agreements

These are solutions where the financier provides design, procurement and project management services. Repayment of the loan to the financier is aligned with the expected energy savings of the project. These solutions may require that projects achieve certain sustainability targets, such as reductions in energy consumption and greenhouse gas (GHG) emissions.

Suited to: Large, credit-worthy organizations that have limits on how much money they can borrow or how much debt they can carry. Large projects with high capital needs, typically starting at $3M – $5M.

Considerations: Can be time-consuming to negotiate agreements and develop projects that meet stringent financial and environmental thresholds. Some level of measurement and verification is usually required after implementation to demonstrate the amount of energy savings achieved from the project.

Energy-as-a-Service (EaaS)

Including EaaS agreements and power purchase agreements

EaaS is a solution where the service provider retains ownership of the energy equipment. Repayment is through a monthly utility bill, where the amount paid is based on the amount of energy consumed by the building.

Suited to: Organizations that prefer to outsource equipment management and maintenance. Retrofit upgrades with a measurable output (e.g. solar photovoltaic systems, lighting, geo-exchange systems).

Considerations: Requires commitment to long-term purchase agreements and reliance on the service provider.

Commercial or residential clean energy improvement programs (CEIP)

These borrowing programs are provided through the local municipality and tie the debt to the property through taxes.

Suited to: Building owners in eligible jurisdictions, in particular those with debt capacity limits. These programs target specific types of building upgrades.

Considerations: Availability of these programs depends on location. Check here for commercial and here for residential.

Other opportunities

Including tax incentives, measure-specific incentives, and carbon monetization

There are other situation-specific opportunities that can reduce costs through local rebates, tax incentives or post-implementation revenue. For example, see our explainer to learn more about two federal tax incentives that may apply to retrofit projects in Canada.

Suited to: Eligible building owners looking to reduce the overall costs of their retrofit projects.

Considerations: Opportunities are specific to certain jurisdictions and availability may come and go over time. Tax incentives may require specialized advisors.

Going beyond the financials

There is a broader business case that can be made for deep energy retrofits. By making your buildings more energy-efficient, you can achieve environmental goals, reduce operating costs and improve occupant experience. These benefits can be used for marketing, may protect your buildings from rising insurance costs and could increase the valuation of your property.

Where can I learn more?

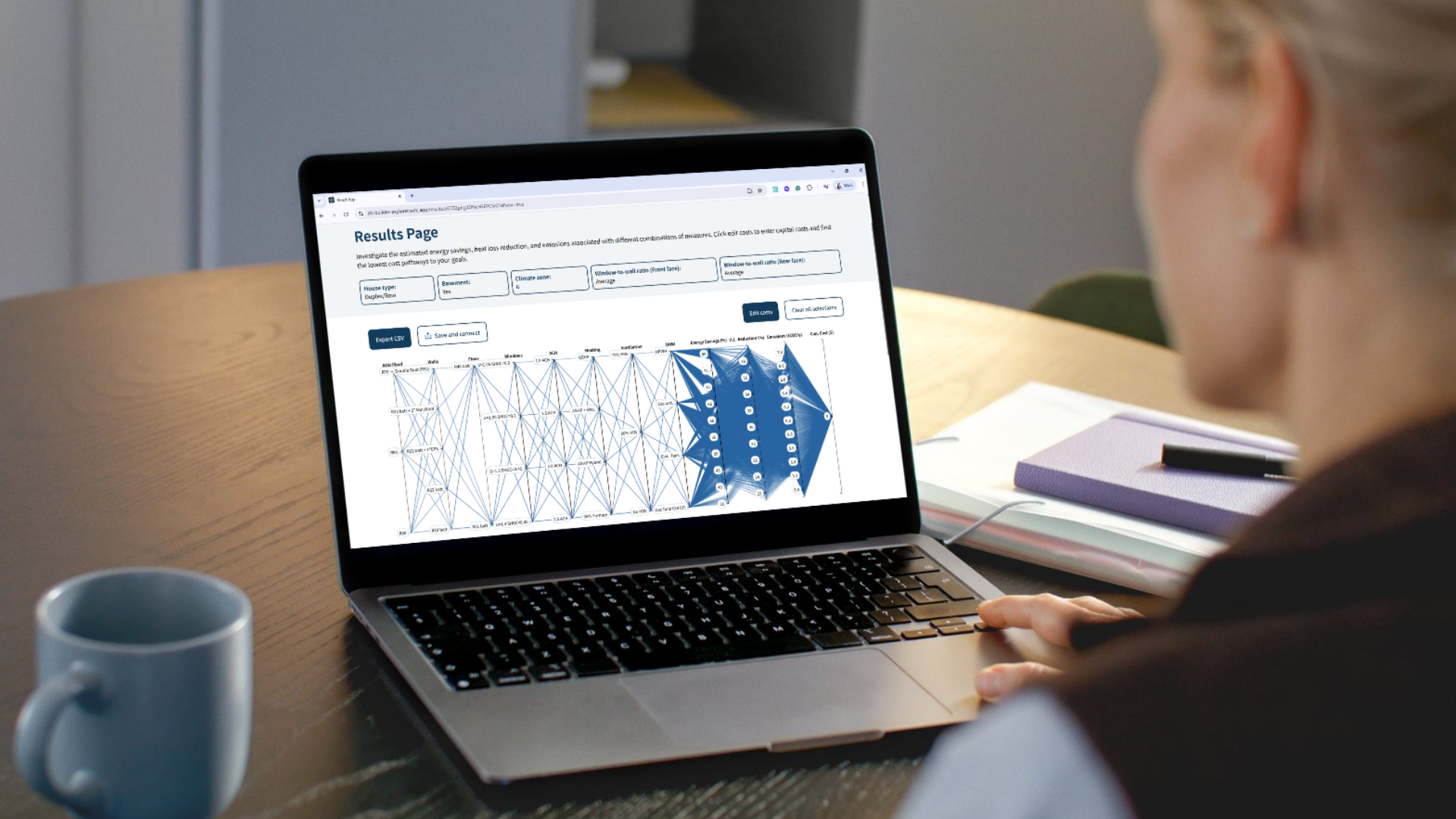

Alberta Ecotrust Foundation (the parent organization of ENBIX) offers free coaching to those interested in undertaking deep retrofits that prioritize energy savings and emissions reductions. The Alberta Ecotrust Retrofit Accelerator program can help you understand the funding and financing options available to you and support you in finding the best solution for your retrofit project. Contact us to learn more and apply for the program.

If you want to dive deeper into research on retrofit financing, we also recommend exploring these retrofit financing resources from the Halifax Climate Investment, Innovation and Impact (HCi3) Fund. Although the resources have some parts that are specific to Atlantic Canada, they also provide general information about retrofit financing , as well as funders, programs and resources that are relevant across Canada.

Disclaimer: The information provided in this document is for general informational purposes only and does not constitute legal, financial or tax advice. We strongly recommend that building owners seek appropriate professional advice before making financial decisions about the options presented here.